How To Leave A Gift In Your Will

Peace of mind and a lasting legacy.

We have produced a Will Guide which contains more information and resources. To download it please fill in the form here:

Family comes first and having a Will in place provides invaluable peace of mind for you and your family. Beyond this, by leaving a gift to the Army Benevolent Fund in their Wills, many of our supporters feel an enormous sense of pride in knowing they will also be leaving a lasting legacy to help safeguard the future of those who have served their country.

There are also tax benefits in leaving a gift in your Will to the Army Benevolent Fund. This cannot only ease the financial burden on your family, but also maximise the impact of your gift.

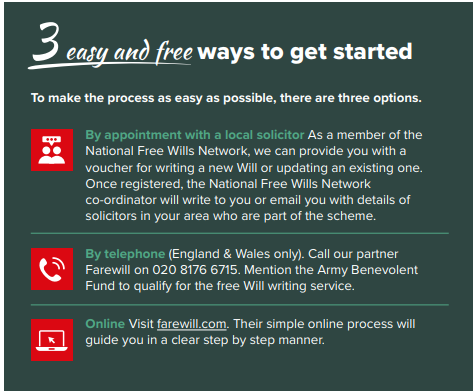

It’s easy to include the Army Benevolent Fund in your Will.

It is essential to consult a qualified solicitor* or professional Will-writer when planning a new Will or updating an existing one. We can offer free Will services for anyone over the age of 18 who want to write or update a simple Will. Our free Will-writing services will guide you through your options and help you decide how you wish to remember our brave soldiers. Alternatively, you can speak to your own solicitor. Your solicitor will need our registered address and charity number which are:

*For advice contact the Law Society of England and Wales, or the Law Society of Scotland.

A great place to start is by making a list of your assets, what you owe and who you want to benefit. You may find it useful to use our will planner.